Utility sales tax exemptions for AL, AZ, AR, CA, CO, CT, DC, FL, GA, ID, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NJ, NM, NY, NC, ND, OH, OK, PA, RI, SC, TN, TX, UT, VT, VA, WV, WI, WY, and their predominant use study requirements can be seen below:

Summary of States with utility sales tax exemptions and their predominant use study requirements can be seen below. National Utility Solutions is currently performing professional engineer-certified predominant use studies for electricity, natural gas, and water meters in all States listed below.

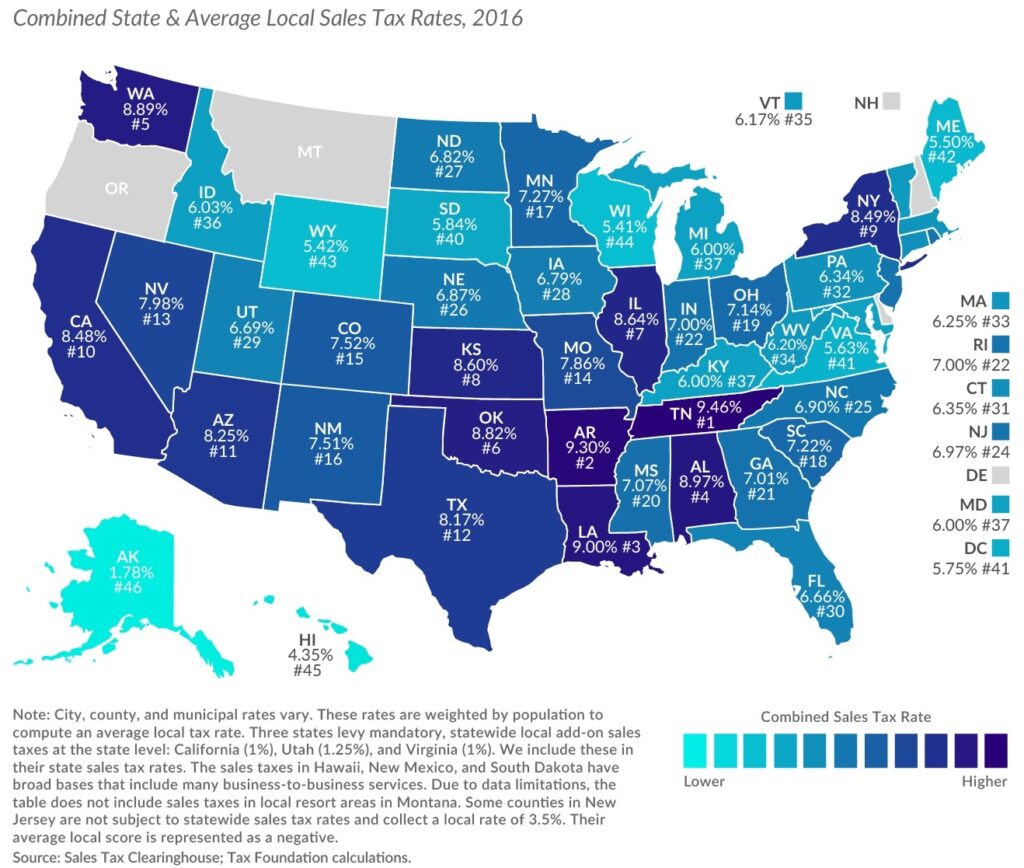

Qualified meters may be fully or partially exempted and refunded for State, City, County, MTA, and Special sales taxes potentially adding up to the savings listed on the map to the left or more (Varies by State, City, and County). Click on the individual States below for State-specific details.

Most States allow utility sales tax exemptions and refund opportunities for electricity and natural gas meters used in qualified processes. The laws will vary from State to State and change periodically as seen below; so please check with us before taking action to make sure the laws are still in effect for your State and industry.

Contact Us for a no-risk, no-obligation quote or call 346-241-0100 or Toll Free 844-767-0037 for immediate answers to questions regarding predominant use studies.

ALABAMA

State sales tax exemptions and refunds are automatic for manufacturing companies. No proof of qualification is required for the utility sales tax exemption as of 08/06/20.

Utility sales tax exemptions are allowed with a predominant use study that proves more than 50% of the electricity or natural gas is used for manufacturing or other exempt uses. Up to 48-months of sales taxes may be recovered.

https://azdirect.az.gov/agencies

ARKANSAS

Beginning July 2007 through June 30, 2008 state tax will be 4.5% vs 5%.

Beginning July 1, 2008 and thereafter, rate will be 4% vs 6%.

Utility must be used directly in manufacturing.

Manufacturing area must be separately metered from taxable area.

http://www.dfa.arkansas.gov/Pages/default.aspx

CALIFORNIA

In the state of California, the gas, electricity, and water, which includes steam, geothermal steam, brines, and heat are considered to be exempt when they are delivered to consumers through the use of mains, lines, or pipes. Fuel oil is considered to be taxable.

Study not required.

https://www.salestaxhandbook.com/california/sales-tax-taxability/manufacturing-and-machinery

COLORADO

Utility sales tax exemptions are allowed for qualified meters for both industrial and commercial residential purposes. Must provide proof of entitlement. Tiered exemption and refund allowed.

https://www.colorado.gov/revenue/default.aspx

CONNECTICUT

Predominant use (76% or more of utility used in manufacturing allows for 100% exemption).

If less than 75% used in manufacturing, partial exemption is possible.

Study required.

http://www.ct.gov/drs/site/default.asp

DC

If more than 50% of the utility (electricity, natural gas, gas, oil, solid fuel, or steam) is used in manufacturing, then a 100% utility sales tax exemption is allowed.

Updates required every 2 years.

Predominant Use Study required.

http://www.otr.cfo.dc.gov

FLORIDA

Tiered exemption system used for electricity exemptions.

Under 50% used in manufacturing does not qualify for exemption, 50% through 75% used in manufacturing receives 50% exemption, 76% and above used in manufacturing receives 100% exemption.

Only specific industries qualify. Check SIC code in classification manual.

Study required.

http://dor.myflorida.com/dor

GEORGIA

Predominant Use Study allows for a 100% sales tax exemption if more than 50% of the usage is for exempt processes. A refund is also allowed going back as far as 48 months. Processing must be handled through the State portal.

Predominant Use Study is required.

https://dor.ga.gov/

Exemption on all utilities delivered by pipes, wires or mains.

No predominant use study required.

http://tax.idaho.gov/

INDIANA

Predominant use (51% or more of utility used in manufacturing allows for 100% exemption.) If less than 50%, then a partial exemption is available. Annual refunds must be applied for from State Refunds and exemptions for water used in all or part of manufacturing and/or processing does qualify.

Predominant Use Study required.

https://www.in.gov/dor/business-tax/sales-tax

IOWA

Actual percentage of utility used in manufacturing.

Updates required every 3 years.

Research & Development does qualify.

Refunds and exemptions for water used in all or part of manufacturing and/or processing does qualify.

Study required.

http://www.iowa.gov/tax

KANSAS

Actual percentage of utility used in manufacturing.

Research & Development does qualify.

Refunds and exemptions for water used in all or part of manufacturing and/or processing does qualify.

Study required.

http://www.ksrevenue.org/

KENTUCKY

100% exemption if the cost of natural gas, electricity, and/or water exceeds 3% of the overall cost of production. Predominant Use Studies are required in addition to the requirement above. Has a 48-month statute of limitations.

LOUISIANA

Beginning July 1, 2008, sales and use tax rate reduced from 3.3% to 2.3%.

After July 1, 2009, no tax applies to electricity and natural gas. Effective July 1, 2018, the aggregate rate of State sales tax is 4.45%. Most business utilities such as electricity, natural gas, water and steam are taxable 2%. Prior to July 1, 2018, the aggregate rate of State sales tax was 5% for the period of April 1, 2016 through June 30, 2018.

MAINE

95% exemption if manufacturing occurs.

No study required.

http://www.state.me.us/revenue

MARYLAND

Predominant use (51% or more of utility used in manufacturing allows for 100% exemption).

Study required.

http://www.comp.state.md.us/

MASSACHUSETTS

Predominant use (75% or more of utility used in manufacturing allows for

100% exemption).

Up to a 36 month refund available.

Research & Development does qualify.

Study required.

http://www.mass.gov/

MICHIGAN

Actual percentage of utility used in manufacturing.

Research & Development does qualify.

Study Required.

http://www.michigan.gov/treasury

MINNESOTA

Limit of two (2) refund claims only per year (regardless of tax type) up to the statute of limitations of 42 months.

Actual percentage of utility used in manufacturing.

Refunds and exemptions for water used in all or part of manufacturing and/or processing does qualify.

Research & Development does qualify.

Study Required.

http://www.taxes.state.mn.us/

MISSISSIPPI

Automatic reduction from the full tax rate down to 1.5% for utilities used in production.

Taxpayer needs to obtain direct pay permit from state and remit the appropriate tax to state.

Water qualifies for exemptions.

Study required.

http://www.mstc.state.ms.us/

MISSOURI

A Predominant Use Study is required to determine the actual percentage of exempt usage for a partial sales tax exemption.

The partial sales tax exemption is filed with the utility provider. Electricity, Natural gas, and Water is exemptible. Refund available through the provider if they will file amended return.

http://dor.mo.gov/index.htm

NEBRASKA

Predominant use (51% or more of utility used in manufacturing allows for 100% exemption).

Refunds and exemptions for water used in all or part of manufacturing and/or processing does qualify.

Study required.

http://www.revenue.state.ne.us/

NEW JERSEY

Must be in Enterprise Zone.

Must employ at least 250 people.

Several other highly restrictive exemptions for qualifying companies available.

http://www.state.nj.us/treasury/taxation/

New Mexico

Predominant Use Study required to determine the exempt percentage allowed.

Partial refunds up to the statute of limitations of 36 months are allowed.

http://www.tax.newmexico.gov/businesses

NEW YORK

Actual percentage of utilities used in manufacturing allows for a partial utility sales tax exemption and refund up to 36 months.

Research & Development does qualify.

Utility company applies 100% exemption on bill.

Taxpayer accrues and pays taxable portion to State using form ST100.

Study required.

https://www.tax.ny.gov

NORTH CAROLINA

Full Exemption available where primary activity is manufacturing. Effective January 1, 2017, N.C. Gen. Stat. § 105-164.13(57) as amended provides the exemption from sales and use tax no longer applies to purchases by a manufacturer of fuel or piped natural gas “that is used solely for comfort heating at a manufacturing facility where there is no use of fuel or piped natural gas in a manufacturing process.” Fuel or piped natural gas sold to a manufacturer for use in connection with the operation of a manufacturing facility continues to be exempt from sales and use tax provided the fuel or piped natural gas is used by the manufacturer in a manufacturing process at the manufacturing facility.

Sales tax can be removed and refunded going back to the statute of limitations of up to 36 months in North Carolina.

http://www.dor.state.nc.us/

North Dakota

All North Dakota utilities: electricity, natural gas, and water are 100% sales tax exempt automatically without any filing required.

No Predominant Use Study required.

All Ohio utilities: electricity, natural gas, and water are 100% sales tax exempt automatically without any filing required.

No Predominant Use Study required.

OKLAHOMA

Predominant use (51% or more of utilities used in manufacturing allows for 100% exemption).

Study required.

http://www.oktax.state.ok.us/

PENNSYLVANIA

Actual percentage of utilities used in manufacturing gets a partial sales tax exemption matching the proven percentage. A refund up to that percentage going back up to 36 months is allowed.

Lighting in plant qualifies.

Study required.

PA Department of Revenue

RHODE ISLAND

Actual percentage of utility used in manufacturing allows for a partial utility sales tax exemption in Rhode Island.

Study required.

http://www.tax.state.ri.us/

SOUTH CAROLINA

Actual percentage of utility used in manufacturing allows for a partial utility sales tax exemption and refund up to 36 months.

Study required.

http://www.sctax.org/default.htm

TENNESSEE

Reduction from the full tax rate down to 1.5% if you are a manufacturer.

Water does qualify. Predominant Use Study is not required in Tennessee.

http://www.state.tn.us/revenue

TEXAS

Predominant use (51% or more of utility used in manufacturing allows for 100% exemption and a refund going back up to 48 months). An engineer from an accredited college must affix the engineer stamp on the study and balance the study with a 12 month history.

Predominant use studies are required.

http://www.cpa.state.tx.us/

UTAH

Predominant use (51% or more of utility used in manufacturing allows for 100% exemption and a refund up to 36 months).

Study with only taxable usage required.

VERMONT

Actual percentage of utility used in manufacturing allows for a partial utility sales tax exemption.

Valid for three years only.

Study required.

http://www.state.vt.us/tax/index.shtml

VIRGINIA

All Virginia utilities are exempt automatically with no predominant use study or filing required.

http://www.tax.virginia.gov/

WEST VIRGINIA

All West Virginia utilities are sales tax exempt with no predominant use study or filing required.

http://tax.wv.gov/Pages/default.aspx

WISCONSIN

Actual percentage of utilities used in manufacturing allows for a partial utility sales tax exemption and refund.

Study required.

https://www.revenue.wi.gov

WYOMING

Actual percentage of utilities used in manufacturing allows for a partial utility sales tax exemption and refund.

Study required.

http://revenue.state.wy.us/